Micro Battery Market with COVID-19 Impact Analysis - Global Forecast to 2026

Micro Battery Market with COVID-19 Impact Analysis - Global Forecast to 2026

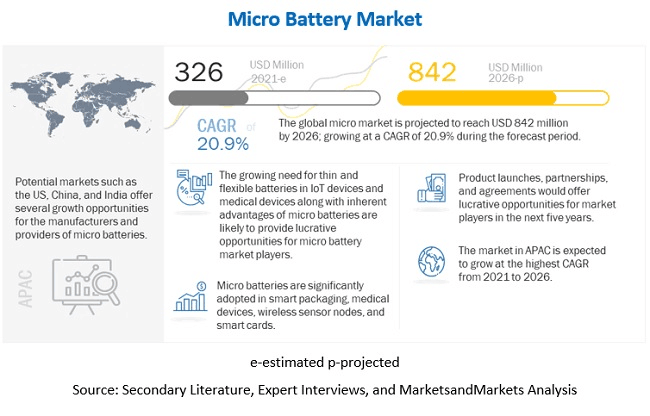

The global micro battery market size is expected to grow from USD 326 million in 2021 to USD 842 million by 2026 at a CAGR of 20.9%.

The growth of the micro market is driven by factors such as the use of printed flexible batteries in medical devices to treat COVID-19 patients, several advantages offered by micro batteries over traditional batteries, increasing adoption of wearable devices, growing use of micro batteries in medical and electronic devices, and demand for thin and flexible batteries in IoT applications.

The market for solid-state chip battery to grow at the highest CAGR from 2021 to 2026

The development of solid-state chip batteries as a replacement for conventional lithium-ion batteries is currently underway in the global micro battery industry. These batteries possess superior safety, longer lifespan, and high reliability as it uses non-flammable, stable, and solid electrolyte materials instead of a liquid. This eliminates the risk of fire and leakage. With the advent of IoT, almost everything is connected to the internet. Battery performance has become one of the essential factors to consider while designing electronic devices in addition to compactness and communication capabilities. Lithium-ion batteries that have high energy density are commonly used today in electronic devices such as electric bikes, drones, and communication devices. However, as these batteries are made up of a flammable, organic solvent electrolyte, they carry a risk of leakage and fire. This has created a need for safer power and more reliable solid-state batteries containing non-flammable and safe electrolyte materials among the IoT device makers. This is expected to drive the demand for solid-state chip batteries over the forecast period.

System integration market for industrial automation in energy & power industry to exhibit high growth during the forecast period

The micro battery market for the secondary battery segment is projected to grow at a higher CAGR from 2021 to 2026. Applications such as consumer electronics, wearable devices, medical devices, and wireless sensor systems require secondary batteries with a long lifespan. With the advancements in technologies used in wearable devices and medical devices, manufacturers are continuously making efforts to come up with innovative designs suitable for their devices. This, in turn, is increasing the requirement for thin, lightweight, bendable, flexible, and high-capacity rechargeable batteries that can last long. Therefore, the demand for secondary micro batteries in the aforementioned applications is high and is expected to increase rapidly during the forecast period.

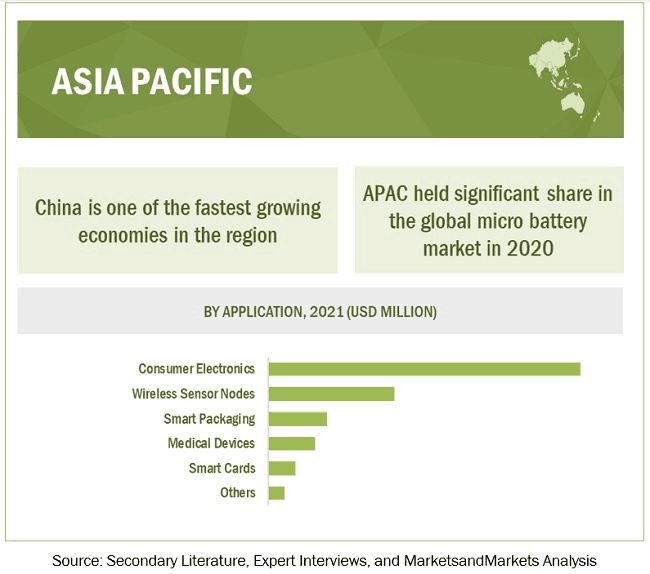

The micro battery market in APAC to grow at the highest CAGR during the forecast period

The micro battery market in APAC is expected to grow at the highest CAGR during the forecast period. The major manufacturers of wearable devices and consumer electronics in this region are miniaturizing their product designs and require micro power sources for compatibility with the miniaturized designs. Technology advancements in smart packaging (e.g., use of printed RFID tags and smart labels in packages), as well as the adoption of medical devices, mainly pacemakers, drug delivery systems, and medical patches, which require lightweight, flexible, and safe power sources, are fueling the market growth in APAC.

Key Market Players

As of 2020, Blue Spark Technologies (US); Cymbet Corporation (US); Enfucell Oy (Finland); Front Edge Technology, Inc. (US); Molex (US); Panasonic Corporation (Japan); Shenzhen Grepow Battery Co., Ltd. (China); TDK Corporation (Japan); Ultralife Corporation (US); VARTA AG (Germany); Murata Manufacturing Co., Ltd. (Japan); Seiko Instruments (Japan); Maxell Holdings, Ltd. (Japan); Renata SA (Switzerland); and Duracell Inc. (US) were the major players in the micro battery market. The study includes an in-depth competitive analysis of these key players in the micro battery market with their company profiles, recent developments, and key market strategies.

Report Scope:

|

Report Metric |

Details |

|

Years considered |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

CAGR |

20.9% |

|

Segments covered |

Battery Type, Rechargeability, Capacity, Application |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Blue Spark Technologies (US); Cymbet Corporation (US); Enfucell Oy (Finland); Front Edge Technology, Inc. (US); Molex (US); Panasonic Corporation (Japan); Shenzhen Grepow Battery Co., Ltd. (China); TDK Corporation (Japan); Ultralife Corporation (US); VARTA AG (Germany); Murata Manufacturing Co., Ltd. (Japan); (China); Imprint Energy (US); Prologium Technology Co., Ltd. (Taiwan, China); Excellatron Solid State, LLC (US); GMB Co., Ltd. (China); and Iten SA (France). |

In this report, the overall micro battery market has been segmented based on type, rechargeability, capacity, application, and region.

By Type:

Button Battery

Thin-film Battery

Printed Battery

Solid-state Chip Battery

By Rechargeability:

Primary Batteries

Secondary Batteries

By Capacity

Below 10 mAh

Between 10 mAh & 100 mAh

Above 100 mAh

By Application

Consumer Electronics

Medical Devices

Smart Packaging

Smart Cards

Wireless Sensor Nodes

Others

By Region

1.North America

US

Canada

Mexico

2.Europe

UK

Germany

France

Rest of Europe

3.Asia Pacific (APAC)

China

Japan

India

Rest of APAC

4.Rest of the World (RoW)

Middle East & Africa

South America

COVID-19 impact on the Global Micro Battery Market

COVID-19 has had a significant impact on the micro battery market and its end users. A few of the end users of micro batteries, such as consumer electronics, wearables, printed electronics, smart cards, and smart textile manufacturers, were badly hit by the pandemic and had to slow down production. However, other end users such as electronic medical device manufacturers had to ramp up and/or set up additional production capacity to adapt to increased consumption. The overall long-term impact of COVID-19 on the micro battery market is expected to depend on various factors, such as the global spread and the duration of the pandemic, actions taken by various government authorities worldwide in response to the pandemic, and the severity of the disease.

Micro Battery Market

Driver: Demand for thin and flexible batteries in IoT applications

The Internet of Things (IoT) provides network connectivity with the help of physical objects in which software and sensors are utilized to deliver data and exchange it with other connected devices. With the decreasing requirement of power in semiconductors and IoT applications experiencing rapid growth, many players are looking for flexible form factors to power distributed electronic devices. Applications such as smart cards, sensors, wireless sensor nodes, smart labels, RFID tags, and packaging require flexibility and thinness to exchange data efficiently. IoT uses traditional batteries to supply power to the network. However, in many applications, sensor performance is hampered due to the size of the battery embedded in the device. Thin and flexible batteries, on the other hand, provide services by harvesting energy for the device. These batteries provide a longer shelf time to sensors as they continuously power the sensors. As a result, the use of thin and flexible batteries in IoT is expected to increase, thus boosting the market for micro batteries.

Restraint: Technical inabilities of micro batteries

Though micro batteries have inherent advantages that enable them to outdo conventional batteries in several application areas, they also come with a few disadvantages that are expected to restrain their adoption in some application areas. As these batteries are small, power consumption takes place faster, thus requiring frequent charges to ensure their long-term use. This leads to limiting the potential application areas for micro batteries. Their size also determines their power capacity. Therefore, micro batteries have low energy density. Though they provide various features and specifications, micro batteries, unlike traditional batteries, cannot deliver high power.

Opportunity: Integration of micro batteries in smart textiles

Smart textiles, also known as electronic textiles, are printed fabrics that sense physiological parameters such as blood pressure, heart rate, and body temperature and adjust the clothing temperature accordingly. These textiles are gaining popularity in the fitness and sports industries. New-generation smart textiles can sense, respond, and adapt themselves to different environmental conditions. Flexible sensors and other components, such as microcontrollers and controlling units, are embedded in smart fabrics to monitor and sense various environmental conditions. Thus, smart textiles require an ultra-thin printed battery solution to power these integrated sensor devices. The increasing popularity of smart textiles has created the demand for printed battery solutions to power them.

Challenge: Complexities in fabrication

Thin-film batteries have several distinctive features, such as high flexibility, lightweight, easy portability, higher power-holding capacity, and excellent energy density. However, the fabrication of such batteries is more challenging than that of conventional rechargeable lithium-ion batteries. During the fabrication of thin-film lithium-ion batteries, it is essential to achieve an optimal match between core components such as nanostructured electrode materials and shape-conformable solid electrolytes and soft current collectors. This enables batteries to maintain stable electrochemical performance even if they are deformed to fit powered devices. However, the fabrication process of such batteries is costly. It also requires a complex screening of solid-state electrolytes, soft current collectors, electrode materials, and full lithium-ion battery?cell assemblies. Thus, the complexity in the fabrication of thin-film lithium-ion batteries acts as a key challenge for the market's growth.

Table of contents:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Components of Micro Battery

7 Micro Battery Market, by Type

8 Micro Battery Market, by Rechargeability

9 Micro Battery Market, by Capacity

10 Micro Battery Market, by Application

11 Geographic Analysis

12 Competitive Landscape

13 Company Profiles

14 Appendix

Related Articles

-

FAI World Drone Soccer Championships 2025 Conclude in Shanghai

2025-11-19 -

Grepow at Future Battery Forum 2025: Showcasing the Lithium Battery Innovation

2025-11-18 -

Powering Aerial Artistry: Grepow Battery Solutions Behind Drone Light Shows

2025-10-27