Will solid-state batteries be the next market outlet?

Recently, Ford and BMW announced the expansion of their investment in the solid-state batterycompany Solid Power in the United States. In the previous few months, car companies such as Weilai and BYD also announced relevant layouts. It seems that overnight, solid-state batteries will become the beginning of 2021. The hottest keyword in the field of power batteries. GREPOW has also begun to develop and produce solid-state batteries in large quantities. So, which companies currently choose solid-state batteries? Compared with the ternary lithium batteries and lithium iron phosphate batteries that have been widely used before, why are solid-state batteries so popular? What changes will it bring to consumers?

"New and old forces" have turned to solid-state batteries

For a long time, power batteries have been a key link in the electrification era, but in the recent period, it seems that "upstarts"-solid-state batteries have appeared in this field.

The reporter learned from foreign media that BMW of Germany and Ford of the United States formally announced on May 3 that they will expand their investment in Solid Power, a solid-state battery company in the United States. Together with other companies, Solid Power has received a total of US$130 million in funding this time. It is worth noting that this is not the only solid-state battery company that has recently been sought after by the market. In November 2020, an American solid-state battery company called Quantum Scape (QS) backdoor listed on the New York Stock Exchange. Although sales were 0, the market value has always exceeded 100 billion yuan, and the market value once exceeded 300 billion when the stock price was highest. Yuan has become a “monster” in the battery field among investors.

In addition to the capital market, solid-state battery products have also appeared frequently in the global automotive market. Domestically, in January 2021, NIO officially announced on NIO Day that it will release a solid-state battery pack product with a single energy density of 360Wh/kg in 2022 to support its new model ET7 (parameters|inquiry ) Endurance exceeds 1,000 kilometers. In April 2021, Honeycomb Energy, a subsidiary of Great Wall Motors, announced that it will join forces with the Chinese Academy of Sciences to build a solid-state battery technology research center. It plans to use solid-state batteries with an energy density of 350-500Wh/kg in mass-produced vehicles in 2025.

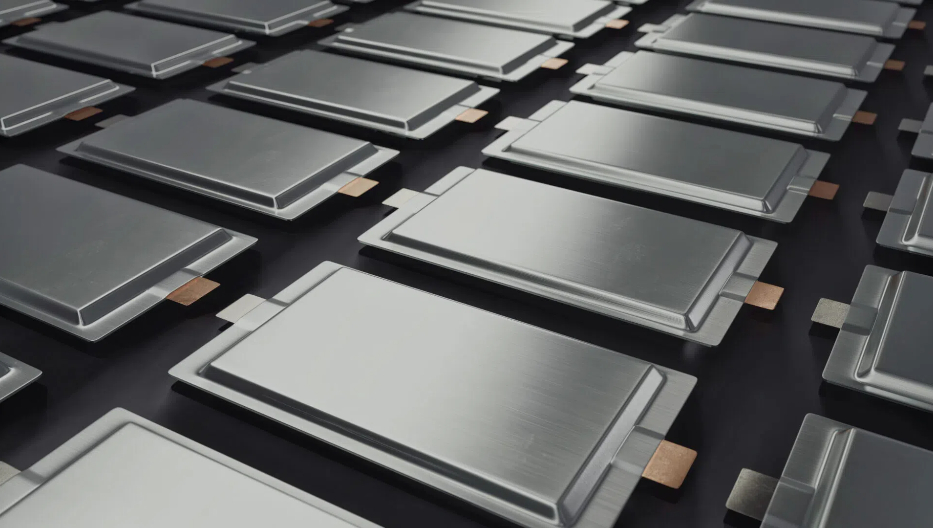

Grepow semi solid battery uses a stacked-sheet pouch cell process and silicon-carbon anode material to significantly break the energy density of existing lipo batteries, which is 275 to 300Wh per kg. The capacity Retention can stay more than 80% after 1000 cycles and the dynamic voltage imbalance is less than 100 mV. This technology is more reliable and light, it has a longer range for professional field drones such as mapping, E-VTOL and consumer electronics. Semi solid batteries can also be customized to perfectly fit the shape of the appliance you need.

Grepow semi solid battery

In other countries, Hyundai Motors is accelerating the research and development of solid-state batteries, and plans to trial production of electric vehicles equipped with solid-state batteries in 2025, with partial mass production in 2027; QS is expected to produce solid-state batteries for Volkswagen electric vehicles as early as 2024; Toyota The car plans to cooperate with Panasonic to launch a limited sale electric car using solid-state batteries in 2025; Honda will start the verification of all-solid-state battery production technology this year, and strive to apply it to models in the late 2020s.

Why can solid-state batteries gain the favor of the market?

From the domestic giants such as Weilai and Great Wall to foreign giants such as Toyota and BMW, in terms of current product planning, solid-state batteries have become the next key battlefield for their competition. Behind this shift in the power battery market, the reporter industry channel learned that it is still a game between battery energy density and safety.

As we all know, there are many technological development routes for dividing power batteries according to materials. However, the only mainstream products in the current market are lithium iron phosphate and ternary lithium batteries. Among them, lithium iron phosphate batteries with low cost, stable material structure, and higher safety have poor performance in energy density, charging and discharging power, and volume; ternary lithium batteries with higher energy density and smaller volume are costly at the same time In terms of security, it is lacking. Due to the advantages and disadvantages of each other, in the past few years, lithium iron phosphate and ternary lithium batteries have never overwhelmed each other with absolute advantages. However, it is worth noting that the current "division of peace in the world" of lithium iron phosphate batteries and ternary lithium batteries has become increasingly fragile.

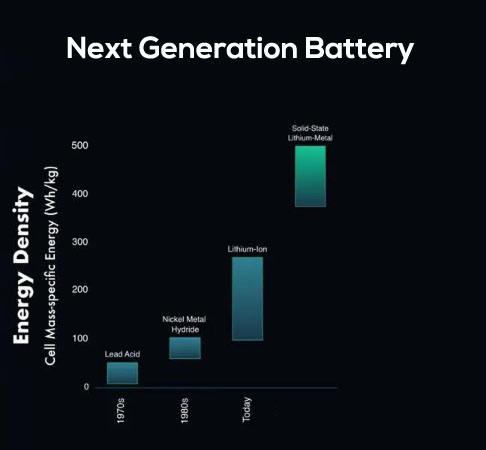

With the continuous development of new energy vehicles, the current market has higher and higher requirements for power batteries. Whether in terms of battery life, energy density or safety, various types of lithium batteries with obvious advantages and disadvantages are obviously not suitable for the requirements of the new era. Public data shows that since the application of lithium batteries to the field of new energy vehicles in 2008, the energy density of power batteries has increased from the original 100Wh/kg to 250Wh/kg. The industry generally believes that the energy density of 300Wh/kg will be the ceiling of liquid electrolyte lithium batteries, which means that the potential of power battery products using the current technology route is almost drained.

In fact, at the 7th China Electric Vehicles Forum this year, Chen Liquan, an academician of the Chinese Academy of Engineering, called for "solid-state lithium batteries to go fast and lead electric China." Chen Liquan said that liquid lithium batteries can easily cause safety concerns , The energy density has reached the limit, the next step is to develop solid-state batteries, or gradually transition to all-solid-state lithium batteries.

It is understood that, unlike lithium iron phosphate/ternary lithium batteries, solid-state batteries replace liquid electrolytes with solid electrolytes, which are not easy to catch fire and explode, which greatly reduces the risk of thermal runaway. At the same time, thanks to the difference in packaging and cooling, solid-state batteries can In a limited space, the weight of the battery is further reduced, and the volumetric energy density is increased by more than 70% compared with the liquid lithium battery (graphite negative electrode), reaching 500Wh/kg.

It is worth mentioning that the data compiled by the Guosen Securities Economic Research Institute shows that with the large-scale production of solid-state batteries and process improvements, their costs are expected to decrease rapidly. Take Huineng's solid-state battery pack as an example. When its cell capacity reaches 20GWh, although the cell cost is still 1.1 times that of the liquid cell with the same energy density, the battery pack cost is only 98%; if MAB (solid-state battery An architecture), its cost is only 70% of the same type of liquid battery.

From the laboratory to the ground, solid-state batteries still take 5-10 years

From the perspective of safety, energy density and cost, solid-state batteries have completely broken the shackles of liquid electrolyte lithium batteries, and can even be said to be the hope of new energy vehicles' mileage. However, it takes a long time for any emerging technology to go from birth to mass production, and solid-state batteries are no exception.

The reporter's industry channel learned that the core technical difficulty that restricts the landing of solid-state batteries lies in the electrolyte. Currently, solid-state batteries can be subdivided into four major technical routes according to different electrolytes: polymer, film, sulfide and oxide. Among them, Japanese and South Korean companies mostly adopt the sulfide solid electrolyte technology route. Chinese companies focus on the oxide route, while European and American companies have developed more balanced development. For example, BMW Ford's Solid Power bet on the development of sulfide-based all-solid batteries. QS solid-state batteries are taking the oxide route. However, no matter which electrolyte material is used, there are still huge challenges to achieve mass production.

"Thin-film solid-state batteries and oxide solid-state batteries are difficult to develop large-capacity power or energy storage batteries; polymer solid-state batteries are limited by the existing PEO (polyethylene oxide) material system, cannot work at room temperature and are difficult to be compatible with high-voltage anodes; vulcanization Solid-state batteries face problems such as electrolyte sensitivity to air, harsh manufacturing conditions, expensive raw materials, and immature large-scale production technology." A relevant expert from the Institute of Physics, Chinese Academy of Sciences told reporters, "Limited by the current level of technology, The mass production of solid-state batteries is expected to take another 5-10 years. From liquid to all solid, the transition should be achieved through a'solid-liquid hybrid' battery."

In fact, the Weilai ET7, which will be mass-produced in 2022, also uses this technical route, rather than a one-step all-solid-state battery. It's a bit confusing to explain, but in essence, the solid-state battery of Weilai ET7 is a lithium battery that contains both solid electrolyte and liquid electrolyte, which is the "solid-liquid mixing" technical route during the transition period.

As for all-solid-state batteries, major power battery companies and OEMs are also trying to overcome difficulties. It is reported that Solid Power, which BMW and Ford are optimistic about, has begun to produce 20Ah all-solid-state batteries, and plans to produce large-capacity 100Ah products on the trial production line in 2022. Peter Lamp, head of BMW battery technology, said that Solid Power, after receiving the B round of financing, is expected to mass produce solid-state batteries for electric vehicles in the next 10 years. QS has set the mass production time in 2024 and said it will establish a joint venture with the Volkswagen Group to produce solid-state batteries and supply batteries for its electric vehicles.

The domestic solid-state battery company Huineng Technology, which is favored by FAW, Tianji, NIO, and Aichi, also announced the time node before. It is expected to conduct trial production in 2023 and mass production in 2024. In addition, the reporter also learned that Huineng Technology’s prototype battery has been manufactured, with a mass energy density of 383Wh/kg and a volume energy density of 1025Wh/L. The cycle test can be done 500 times. In addition to these three market leaders, Toyota is also recognized as one of the most powerful players in the field of solid-state batteries in the industry. According to the plan, Toyota plans to launch a prototype car in 2021 and start mass production around 2025.

According to the information released by various companies, the mass production time of all solid-state batteries of each company is very close, and 2025 has become a key time node. Prior to this, products such as the "solid-liquid hybrid" technology route generally adopted by Weilai ET7 will be listed first, and a new round of competition in the power battery market may begin.

Related Articles

-

NMC Battery vs. LCO Battery: What’s the Difference?

2024-10-11 -

3D Mapping Drone Helps Create The Popular Game Black Myth: Wukong

2024-08-23 -

Next-Generation eVTOL Battery Technology

2024-08-22